Which of the following is a method used for evaluating the profitability of an investment by finding the interest rate that equates the present value of cash inflows with the present value of outflows?

Which of the following is a method used for evaluating the profitability of an investment by finding the interest rate that equates the present value of cash inflows with the present value of outflows?

Explanation

NPV is the difference between the present value of cash inflows and cash outflows over a period of time.

NPV stands for Net present value

It is used in capital budgeting and investment planning

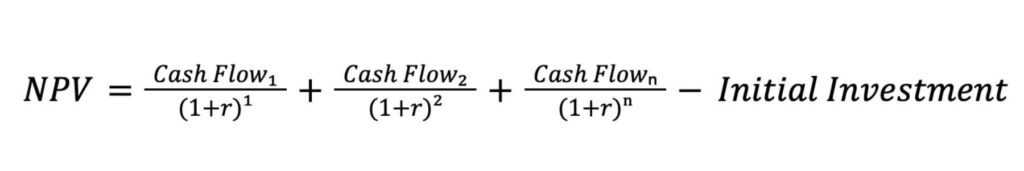

formula:

NPV = Cash Inflow Year 1 / (1 + Discount Rate)^1 + Cash Inflow Year 2 / (1 + Discount Rate)^2 + ... + Cash Inflow Year n / (1 + Discount Rate)^n - Initial Investment