Which of the following is a method used for evaluating the profitability of an investment by finding the interest rate that equates the present value of cash inflows with the present value of outflows?

Answer: NPV

Explanation

NPV is the difference between the present value of cash inflows and cash outflows over a period of time.

NPV stands for Net present value

It is used in capital budgeting and investment planning

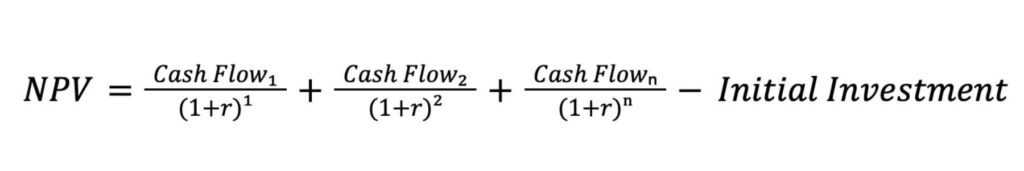

formula:

NPV = Cash Inflow Year 1 / (1 + Discount Rate)^1 + Cash Inflow Year 2 / (1 + Discount Rate)^2 + ... + Cash Inflow Year n / (1 + Discount Rate)^n - Initial Investment

This question appeared in

Past Papers (5 times)

OTS Past Papers (2 times)

ZTBL OG III Past Papers and Syllabus (3 times)

This question appeared in

Subjects (1 times)

MATHS MCQS (1 times)

Related MCQs

- What is the term for the interest rate that makes the present value of an investment's cash flows equal to its price?

- If the initial investment for a project is Rs 50,000, the cash inflows are Rs 20,000 per year for four years, and the discount rate is 10%, what is the NPV?

- If the initial investment for a project is Rs 80,000, and discounted cash inflows are Rs 30,000 per year for three years, what is the IRR?

- What happens to the future value of an investment if the interest rate increases?

- Find interest on Rs. 40,000 at the rate of 3% annually for 4 years investment?

- What does the present value of an investment represent?

- Rs. 6000 is lent out in two parts. One part is lent at 7% p.a simple interest and the other is lent at 10% p.a simple interest. The total interest at the end of one year was Rs. 450. Find the ratio of the amounts lent at the lower rate and higher rate of interest?

- What happens to IRR if the cash inflows are delayed?

- An automobile financier claims to be lending money at simple interest, but he includes the interest every six months for calculating the principal. If he is charging an interest of 10%, the effective rate of interest becomes :_________?

- How does a delay in cash inflows affect NPV?